SHOP EVERYDAY GOODS AT EVERYDAY LOW PRICES

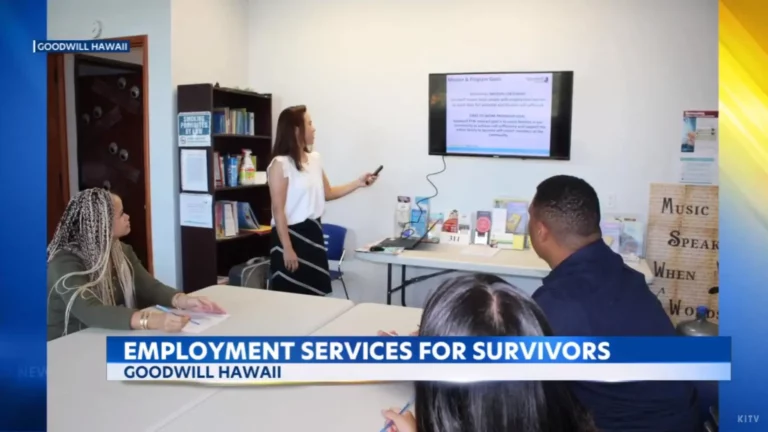

SERVICES FOR JOB SEEKERS

We provide free job training, education, placement and support services to strengthen Hawaii’s communities through the power of work.

enroll in kapolei

charter school

Kapolei Charter School by Goodwill Hawaii is a free public charter school in West Oahu offering students an alternative learning environment to assist them in earning a Board of Education high school diploma and preparing for long-term success and self-sufficiency.